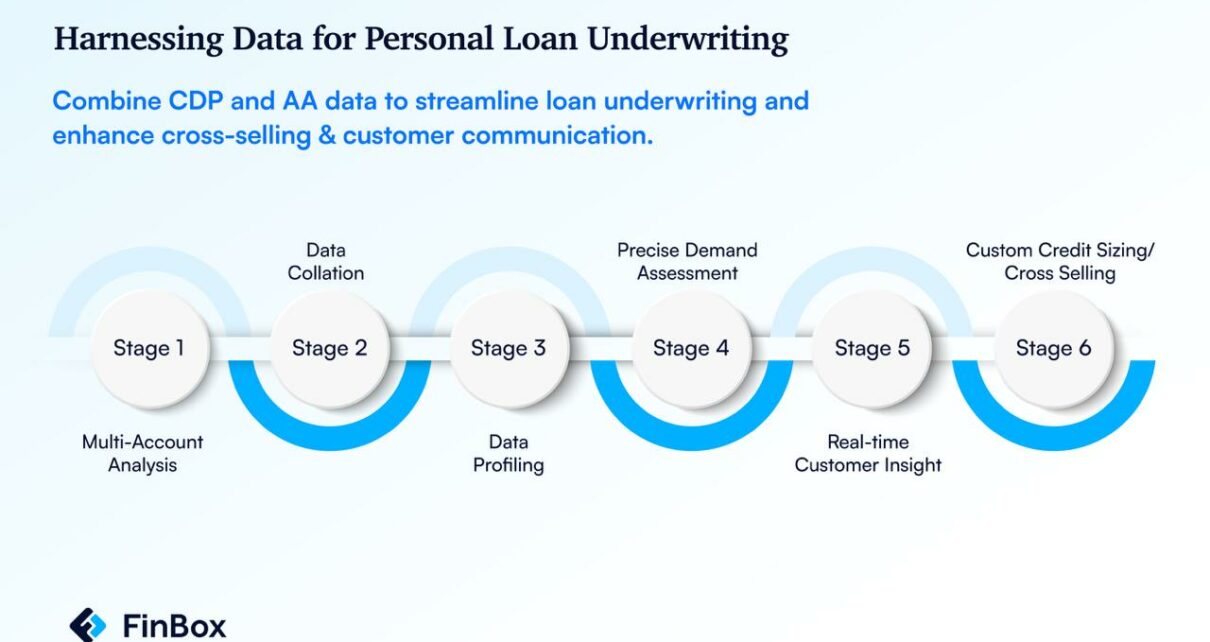

December 02, 2024, National: FinBox, One of India’s leading credit infrastructure and risk intelligence companies – has recently announced the launch of an Account Aggregator based Customer Data Platform (CDP) This unified platform will enable banks and NBFCs to access extensive customer data points and get actionable insights real-time. Designed to support diverse use cases beyond underwriting, the platform aims to enhance lenders’ ability to assess their customers’ financial health with greater precision and speed.

In financial institutions, customer data is often fragmented, stale, and locked away in siloed databases while executives struggle to form strategies to drive more revenue. FinBox’s AA CDP solves this problem by ensuring decision-makers can automate rules and triggers to build customer cohorts. This helps them build exciting use cases on top of data, including early warning systems, portfolio monitoring, credit cards line management, cross-sell, up-sell, and more, FinBox said.

Rajat Deshpande, CEO & Co-Founder of FinBox, says – “Account Aggregation enables exciting new possibilities of building data-rich workflows that can drive a lot of revenues for lenders. The use-cases don’t have to be limited to underwriting, and this prompted us to build this CDP product as a unified offering which builds the foundation for a data-driven product and solutions offering. We built CDP to function like the brain’s cerebral cortex for financial institutions, gathering and organizing all relevant customer information in one place. By integrating data from multiple sources, the platform enables institutions to identify patterns and uncover opportunities in real-time. Traditionally, this process could take days or even weeks, often leading to missed opportunities because no one was specifically tracking such signals. With our platform, these insights are readily accessible, driving smarter, faster decision-making.“

The current pace of innovation in the financial ecosystem is pushing even legacy institutions to build smarter solutions to get that edge in a highly-competitive market. As digitization increases, lenders are vying to utilize more and better data streams to personalize their offerings at scale.

Whether it’s providing early warning systems based on transaction patterns or monitoring borrower health in real-time without the need for quarterly checks, the platform will help businesses generate and organize a huge library of customer data and find cross-selling opportunities based on objective data points. .

For more details, please visit here: https://finbox.in/blog/introducing-finbox-aa-customer-data-platform-your-gateway-to-precise-consumer-insights-/

About FinBox:

FinBox is a rapidly scaling fintech start-up based in Bangalore that provides embedded finance infrastructure and digital lending solutions to start-ups and enterprises worldwide. The FinBox suite works across alternate data scoring, embedded credit lines, financial data integration, and analysis.

FinBox currently boasts of more than 75 clients across its credit infrastructure and risk intelligence offerings. The company is setting up a presence in the South East Asia with live clients across Vietnam, Phillipines and Indonesia.