Trusted since 1994, NJ Wealth has become a leading platform in the mutual fund distribution industry, helping distributors build successful businesses while serving millions of families across India and globally. With its robust technology-driven platform, NJ Wealth provides the tools, resources, and ongoing support to distributors, allowing them to scale operations, enhance client relationships, and offer long-term wealth-building strategies. Whether transitioning from insurance, sales, or other sectors, distributors have leveraged NJ Wealth’s training and resources to achieve remarkable growth and success.

Today, NJ Wealth is overseeing ₹ 2,71,338 crore in AUM, with over 41,65,204 happy investors and over 50,932 active distributors. The company’s digital platform ensures distributors can operate efficiently, while the continuous educational support keeps them ahead of market trends. These success stories highlight how NJ Wealth’s blend of personalized service, advanced technology, and strategic guidance has empowered distributors to achieve sustainable growth and foster lasting client success.

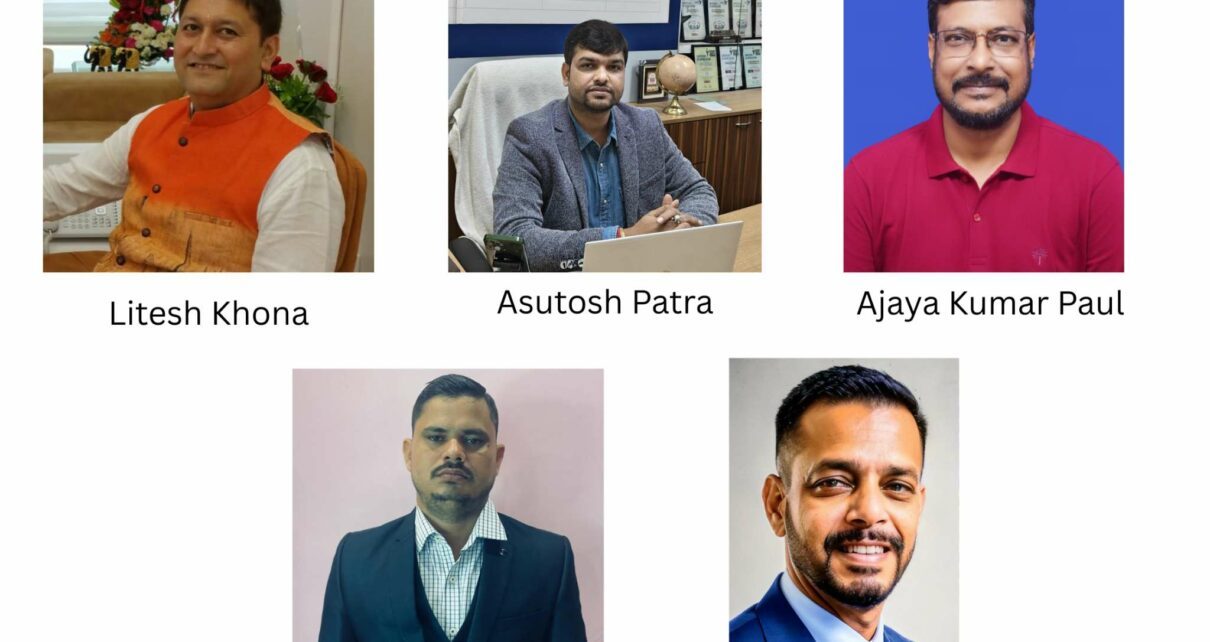

Litesh Khona – Mumbai

A third-generation financial professional, Litesh Khona began his career in 1993 with an LIC agency, achieving MDRT recognition for 20 consecutive years. As inflation challenged traditional returns, he evolved, earning his CFP in 2009 and QPFP in 2023 to offer holistic financial guidance. Joining NJ Wealth in 2014 marked a new chapter. Leveraging NJ’s robust digital tools, he transitioned nearly all clients to demat accounts by 2018, ensuring transparency and efficiency. Today, Litesh oversees an impressive ₹550 crore AUM with a ₹4 crore SIP book, serving over 500 families. With his son Urmil now joining the business as a fourth-generation mutual fund distributor, Litesh credits NJ Wealth’s mentorship and technology for enabling long-term, trust-based wealth building. His guidance: “Think beyond returns, embrace technology, and commit fully to building enduring client relationships.”

Asutosh Patra – Bhubaneswar

From a banker to a ₹220 crore mutual fund distributor, Asutosh Patra’s journey is one of vision and reinvention. After successful stints with ICICI Bank and HDFC Life, he transitioned to mutual fund distribution in 2017 with NJ Wealth as his trusted partner. Focused on retirement objectives and life-stage strategies, Asutosh leverages NJ’s advanced technology and research ecosystem to craft SIP-led accumulation strategies for young investors and SWP-based income strategies for retirees. Alongside his wife, Lavanya Parida, who oversees operations, he serves over 600 mutual fund clients and 1,000+ across financial products. His philosophy is simple yet profound: dedication, honesty, continuous learning, and unwavering client focus. Asutosh affirms, “NJ Wealth doesn’t just provide technology, it provides confidence.”

Ajaya Kumar Paul – Bhubaneswar

Resilience defines Ajaya Kumar Paul’s journey. Starting in 2005 with Janit Consultancy, he faced industry challenges during the 2008 crisis and entry load reforms, but found his breakthrough after joining NJ Wealth in 2012. With NJ’s comprehensive digital platform, portfolio review systems, and family mapping tools, Ajaya elevated his practice to new heights. Today, he oversees ₹98 crore in AUM and a ₹76 lakh monthly SIP book, serving 638 clients. One of his hallmark achievements includes transforming a client family’s traditional bank portfolio into a well-diversified ₹7 – 8 crore mutual fund portfolio. Partnering with Satya Ranjan Pradhan, Ajaya aspires to reach ₹1,000 crore in AUM and serve 5,000 clients powered by NJ’s technology and vision.

Hemanta Kumar Pati – Bhubaneswar

Dedication and trust have been the cornerstones of Hemanta Kumar Pati’s rise to ₹100 crore AUM. Beginning with ICICI Prudential Life Insurance, Hemanta discovered his passion for mutual funds upon joining NJ Wealth in 2009, a turning point in his career. Today, he serves nearly 600 clients with a ₹40 lakh monthly SIP book, supported by NJ’s seamless digital ecosystem. He has seen investor confidence grow significantly, particularly post-COVID, as clients increasingly value professional guidance. Overseeing investments across three generations of families stands as his proudest accomplishment. Hemanta attributes his success to NJ’s technology, training, and local support network, advising new distributors: “Stay dedicated, honest, and informed. India’s mutual fund industry still holds immense opportunity.”

Siddartha Babu – Bhubaneswar

A story of remarkable courage and reinvention, Siddartha Babu’s journey is a testament to resilience. After nearly 30 years in banking with UTI Bank, EU Bank, and Catholic Syrian Bank, a stroke in 2021 changed his life. Returning to Balangir, he rebuilt his career as a mutual fund distributor through NJ Wealth’s digital platform. Its paperless processes, strong support system, and easy-to-use tools helped him regain confidence and independence. In just three years, he has built a ₹25 crore AUM practice with a ₹26 lakh monthly SIP book, serving over 400 clients from diverse backgrounds. Recipient of NJ Wealth’s Emerging Partner Award 2023, Siddartha also contributes to community development through social initiatives and health camps. His journey embodies perseverance, purpose, and the transformative power of technology.

Building Legacies Through Trust and Technology

These five NJ Wealth partners reflect the spirit of India’s financial transformation, where personal dedication meets digital empowerment. With NJ Wealth’s visionary platform, mentorship, and unwavering focus on investor success, they continue to shape the future of financial distribution, turning aspirations into enduring wealth stories.