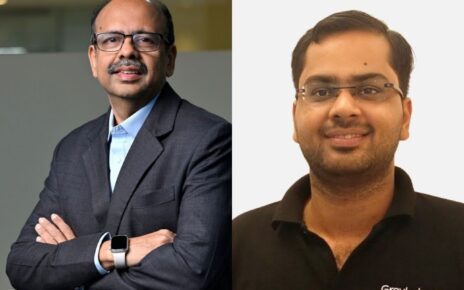

In India’s rapidly evolving fintech landscape, Rupee112 is quietly but powerfully revolutionizing how personal loans are accessed, approved, and disbursed particularly for India’s vast salaried segment that often slips through the cracks of traditional banking. Founded by Vikkas Goyal, an entrepreneur with deep insights into the challenges faced by middle-income earners, Rupee112 isn’t just another digital loan provider. It’s an RBI-registered NBFC with a mission to bring speed, dignity, and fairness to lending.

What sets Rupee112 apart is its seamless fusion of artificial intelligence with human empathy. The platform uses real-time data and behavioral signals far beyond just credit scores to evaluate a borrower’s eligibility, offering instant and paperless loans tailored to real needs. It doesn’t stop at fast disbursement; it’s equally focused on financial inclusion, responsible lending practices, and consumer protection. In an era where fintech is growing rapidly but not always ethically, Rupee112 is quietly building a trust-first digital lending model, one that puts the borrower at the center while leveraging cutting-edge AI to do so at scale.

Breaking Barriers in Borrowing

Mr. Goyal launched Rupee112 to address a persistent gap in the financial system — the underserved salaried professional, particularly in Tier 1 and Tier 2 cities. Traditional banks often deny loans to people with limited or no credit history, despite them being stable earners. Rupee112 steps in as an alternative, offering personal loans of up to ₹1 lakh with instant approval and disbursal, often within 30 minutes all without paperwork or physical visits.

The Fin-AI Engine: Lending with Intelligence

The core of Rupee112’s offering lies in its AI-driven credit engine. Instead of relying solely on credit scores, the platform evaluates real-time data like monthly income flows, employment tenure, device behavior, and even banking SMS patterns. This broader lens helps identify creditworthy individuals who may have been overlooked by traditional lenders. The result? More inclusive, risk-aware lending decisions that benefit both the borrower and the business.

WhatsApp as a Loan Counter

Rupee112 is one of the few NBFCs in India enabling loan applications via WhatsApp. This innovation simplifies the process further for users who might not be comfortable navigating a fintech app or digital dashboard. The platform’s conversational interface allows applicants to check eligibility, upload documents, and receive disbursements — all within a familiar chat experience.

Speed with Responsibility

While speed is a major selling point, transparency and fairness are equally embedded into Rupee112’s DNA. There are no hidden charges, are clearly communicated, and borrowers face no foreclosure penalties. Unlike many digital lenders criticized for aggressive recovery tactics, Rupee112 follows RBI guidelines and has a strong policy of ethical, respectful collections even in cases of default.

Building for India’s Financial Heartland

Today, Rupee112 is live in over 80 Indian cities, reflecting its commitment to go beyond metros and reach India’s true financial backbone: its salaried middle class. The platform primarily serves users aged 25 to 55, many of whom rely on Rupee112 for emergency expenses such as medical bills, travel, education, or wedding-related costs.

Tech-Driven. User- Centric.

Rupee112’s mobile-first design includes features like biometric verification, fraud detection, and real-time loan tracking. Its backend uses AI not just for approvals but also for monitoring repayment patterns, improving product personalization, and maintaining strong compliance and security.

Scaling with Soul

With over a million app installs and lakh of loans disbursal, Rupee112 has scaled rapidly while maintaining a strong user-first culture. The startup is profitable, regulated, and widely trusted, a rare combination in the Indian fintech world.

Vikkas Goyal, Rupee112 is about more than just fast credit. “We’re building a platform people can trust not just for money, but for peace of mind,” he says. This philosophy is evident in everything from product design to customer support to collections. At a time when digital lending is being re-evaluated for transparency and fairness, Rupee112 sets a gold standard for what Fin-AI can achieve.